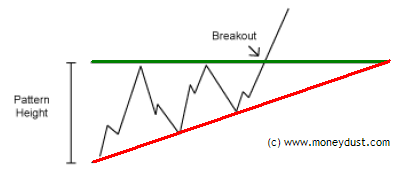

When you notice a stock has a series of increasing troughs and the price is unable to break through a price barrier, chances are you are witnessing the birth of an Rising triangle pattern.

Confirm your Rising triangle pattern by drawing a horizontal line tracing the upper price barrier and a diagonal line tracing the series of Rising troughs.

The Falling triangle is the bearish counterpart to the Rising triangle.

Confirm your Falling triangle by drawing a horizontal line tracing the lower price barrier and a diagonal line tracing the series of Falling troughs.

The Rising and Falling patterns indicate a stock is increasing or decreasing in demand. The stock meets a level of support or resistance (the horizontal trendline) several times before breaking out and continuing in the direction of the developing up or down pattern.

How to Profit from Rising and Falling Triangles

Rising and Falling triangles are short-term investor favorites, because the trends allow short-term traders to earn from the same sharp price increase that long-term investors have been waiting for. Rather than holding on to a stock for months or years before you finally see a big payday, you can buy and hold for only a period of days and reap in the same monster returns as the long-time stock owners. When you learn to identify Rising and Falling triangles, you can profit from upwards or downwards breakouts. That way, you’ll earn a healthy profit regardless of where the market is going.

Watch For:

• An Rising or Falling pattern forming over three to four weeks.

Set Your Target Price:

For Rising and Falling triangles, sell your stock at a target price of:

• Entry price plus the pattern’s height for an upward breakout.

• Entry price minus the pattern’s height for a downward breakout.

No comments:

Post a Comment